types of tax in malaysia

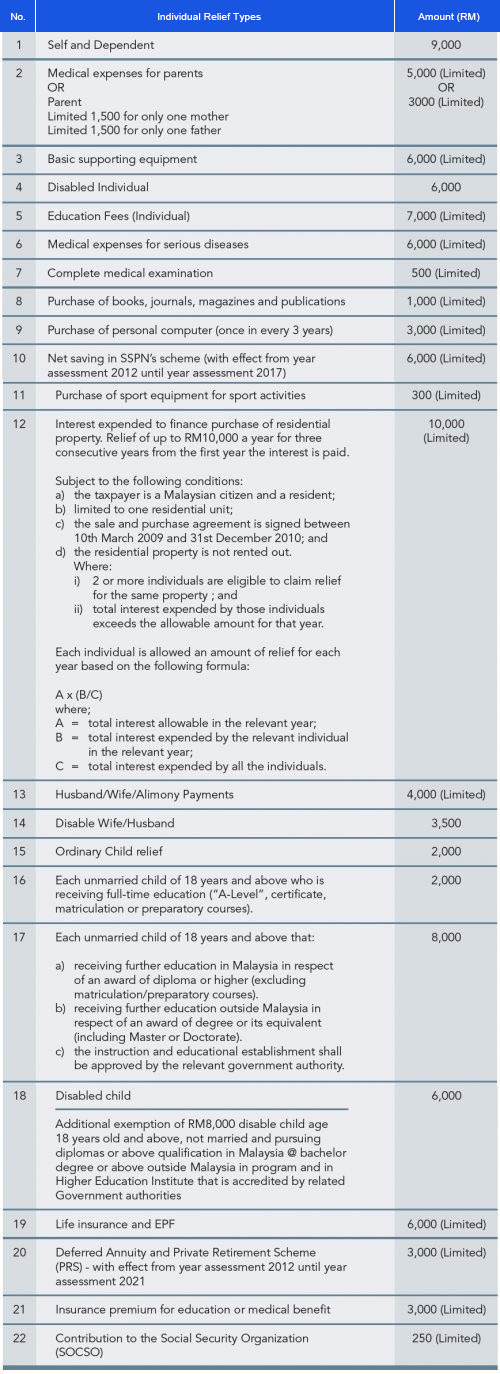

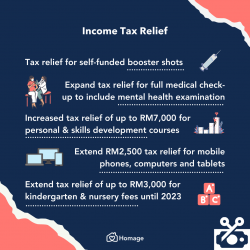

A direct tax is a tax that is levied on a person or companys income and wealth. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Pdf A Review On Taxation System Optimization Approaches

Based on Malaysias Sales Tax Exemption.

/ScreenShot2021-05-17at12.18.32PM-420d9ea4a4974f85814c456d6f5fe2f3.png)

. Basically homeowners will now just pay the tax for their own parcel their own unit. The income tax of non-residents is calculated on a three-step tax rate 27 15 and 10 depending on the type of income. Value added taxes excise charges quit rent Goods and Services Tax Service Tax and Sales Tax and other indirect taxes are examples.

Remittances of foreign-source income into Malaysia by tax residents of Malaysia are not. Cukai taksiran is a much more familiar term for this type of tax. Rent Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive.

The amount of discount received is taxable too. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. RM 250000 x 15 RM 37500.

For the first RM 100000 stamp duty is one percent. One thing to mention that every Malaysian are entitled to get tax exemption only once in an individual life time but this. The sales tax exemption can be categorised into two groups such as exemption by order of the minister and specific exemption.

The calculation of individual threshold of non. Property taxes in Malaysia are not as bad as one might expect. Watch on This section explains the payment types their definition and withholding tax applied.

The income tax rate for residents is calculated on the. The rate applicable to rental of movable properties technical or management services fees as well as the withholding tax on dividends. Stamp duty is based on the purchase price.

Self-employment and business income - All profits accruing in Malaysia are subject to tax. Contract payments to non-resident contractors in respect of services under a contract project are subject to a 13 deduction of tax 10 on account of the contractors tax liability. The tax applicable to interest.

Direct taxes are taxes on profits or. Apart from the SPA Stamp Duty and Real Property Gains Tax RPGT all the other costs are very manageable and. Withholding Tax Malaysia 10 but you can get 8 if you know how to.

There are two types of taxes. The tax is paid directly to. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. When purchasing a property stamp duty must be paid on the Memorandum of Transfer. They are also eligible for tax deductions.

There are two different kinds of taxes in Malaysia which are a direct and indirect tax. Expatriates deemed residents for tax purposes pay progressive rates between 0 and 30 depending on their income.

Malaysia Payroll And Tax Activpayroll

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Understanding Tax Smeinfo Portal

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Malaysia Avoiding Rental Pitfalls Asean Economic Community Strategy Center

Pdf Tax And Revenue Trends And Implications In Malaysia

Business Income Tax Malaysia Deadlines For 2021

How Does The Current System Of International Taxation Work Tax Policy Center

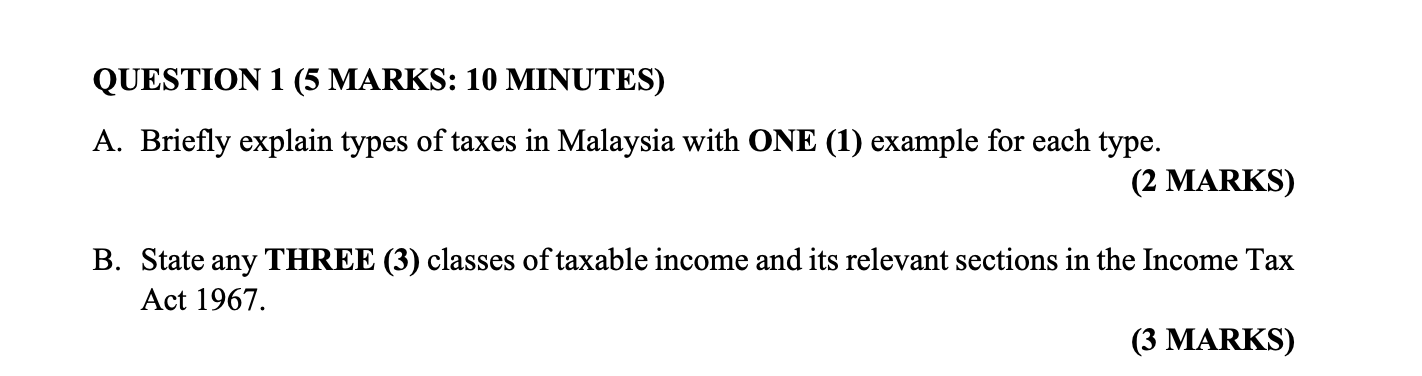

Solved Required Discuss In Detail All The Various Types Of Chegg Com

Pdf Tax And Revenue Trends And Implications In Malaysia

Types Of Withholding Tax Malaysia Sap Simple Docs

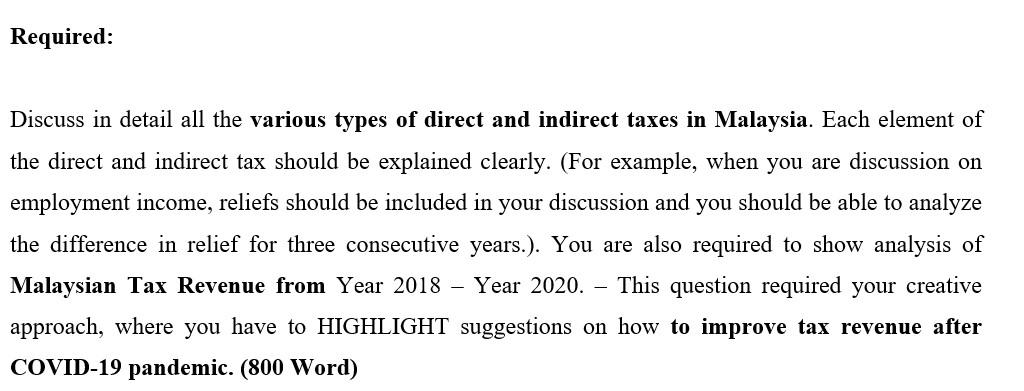

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Impacts Of The Self Assessment System For Corporate Taxpayers

Solved This Is Principle Of Taxation Question Please I Need Chegg Com

Introduction To Taxation In Malaysia Acclime Malaysia

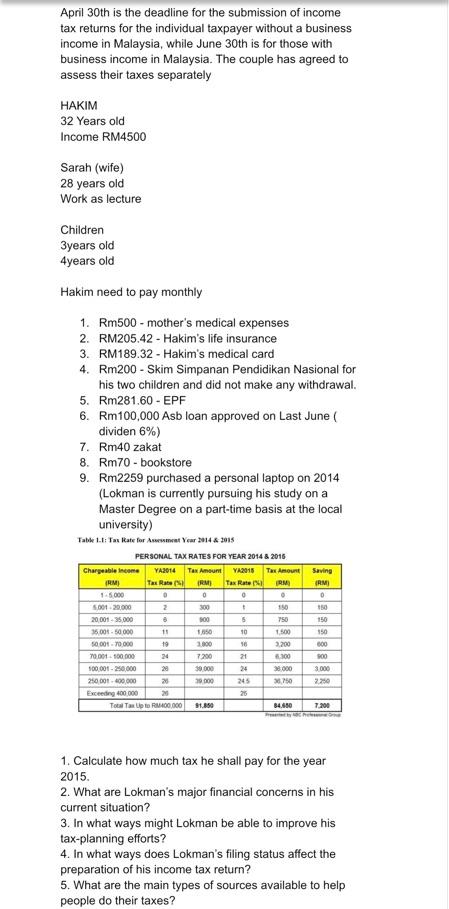

April 30th Is The Deadline For The Submission Of Chegg Com

Customer Tax Ids Stripe Documentation

0 Response to "types of tax in malaysia"

Post a Comment